21 May 2014

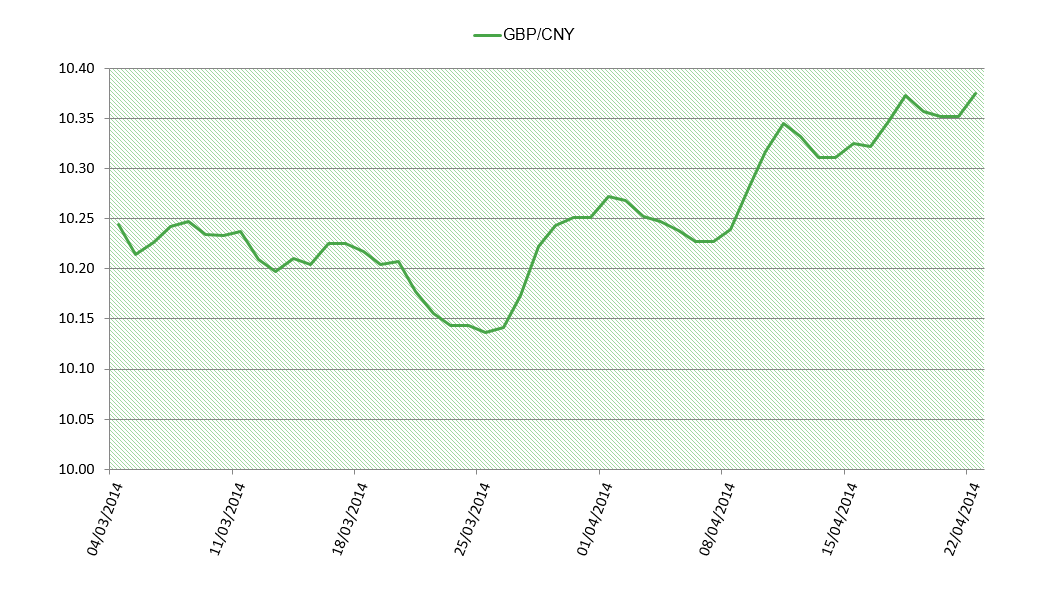

CNY (Chinese renminbi) Current Rate:

CNY10.53/£1; CNY6.23/US$1

Despite the fears encircling China’s economic slowdown, the country is still enjoying growth at around 7%. In addition to that, the sheer volume of the Chinese economy means that, although the growth rate is steady, the volume of growth is comparable to that before the slowdown.

Figures released by the International Comparison Programme hosted by the World Bank going into May indicated that China is poised to overtake the US as the world’s largest economy this year – sooner than anticipated. This follows on from another mantle that China seized from the US earlier this year, as the world’s largest trading nation.

Growth in the economy, labour market and foreign trade have all contributed to a positive outlook for the country. Having widened its trading band against the US dollar earlier this year, the Chinese Renminbi weakened in less safe – and less managed – waters. This was suggested by some as a ploy to increase China’s export competitiveness. Whatever the case, it appears that China is slowly coming into its own and on its way to becoming the world economic superpower.

We look to the Initial Public Offering for Chinese E-commerce company Alibaba for reflections of sentiment concerning Chinese consumption. Companies like Alibaba are hinged on a growing middle class, which comes complete with disposable incomes and a penchant for spending (rather than the traditionally Chinese habit of saving). China is not expected to only produce more, it is also expected to consume more.

Given these reasons, we expect to see the Renminbi strengthen over the coming months. However, it must be remembered that the currency still has some way to go before it will be a free float and that there are currently too many variables for us to compute if it will succeed, or indeed what the likely timescales will be.

Rate forecasts for GBP/CNY:

| Time Length | Rate |

| 1 month | 10.4496 |

| 3 months | 10.2847 |

| 6 months | 10.1229 |

Forecasts accurate from 20 May 2014. Data taken from Reuters’ poll.

Data sourced from GBP/USD and USD/CNY cross.

For help and guidance on making international payments using Chinese renminbi,

call 020 7898 0500 or send us an email

020 7898 0500

020 7898 0500