22 July 2014

CNY (Chinese renminbi) Current Rate:

CNY 10.5271/£1; CNY 6.1636/US$1

China continued to edge the door open to a free-floating market in June, with ambitions to rebalance the global economy by promoting the cross-border use of renminbi. To this end, the People’s Bank of China (PBoC) struck an agreement with the Bank of England (BoE) back in March to collaborate in order to facilitate the goal. The conversation rose in June, with the BoE appointing the China Construction Bank (CCB) – one of China’s ‘Big Four’ banks – as the Chinese clearing bank in London. Given that London is already a main hub for trading renminbi, the move should further cement the China-UK relationship.

While the US dollar is still the most used currency in trade finance, the renminbi is in second place. The Chinese currency is also in the top ten of the most used currencies for payment across the globe. Because of this, government export credit agency UK Export Finance (UKEF) has recognised its prominence and begun to support renminbi loans. These take the form of medium and long-term guarantees on transactions in renminbi, which are valid for transactions in any industry – analysts expect them to focus on the aerospace sector at the start.

China also announced its intentions to widen the renminbi’s international presence by signing a bilateral currency swap line with Switzerland in late July, in the hope of creating another trading hub for the Chinese currency. This will allow the two central banks to exchange currency directly, further smoothening the renminbi’s path to participation in free-floating currency markets.

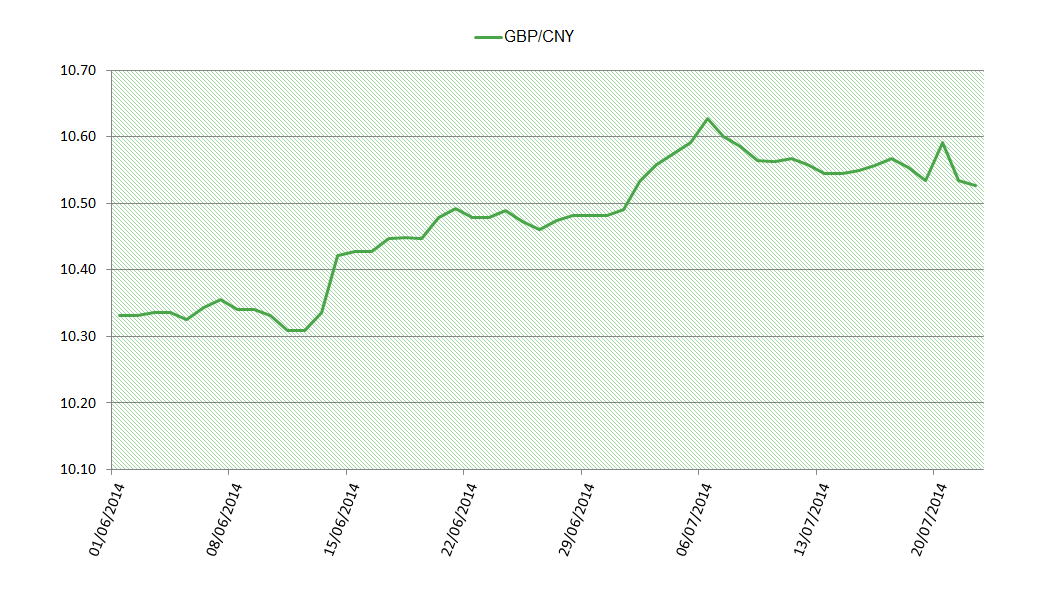

Although the renminbi has been weakening since its foray into less tightly-controlled waters, forecasts for its strength against sterling continue to be optimistic.

Rate forecasts for GBP/CNY:

| Time Length | Rate |

| 1 month | 10.5400 |

| 3 months | 10.4890 |

| 6 months | 10.2785 |

Forecasts accurate from 21 July 2014. Data taken from Reuters’ poll.

Data sourced from GBP/CNY and USD/CNY cross.

For help and guidance on making international payments using Chinese renminbi,

call 020 7898 0500 or send us an email

020 7898 0500

020 7898 0500