R&D Tax Credits

R&D Tax Credits

Research and Development (R&D) Tax Credits are government schemes that were introduced in 2000-01 for SMEs and 2002-03 for larger companies. The schemes function as a tax incentive for UK businesses by encouraging innovation and are a vital contributor to wealth creation.

Indeed, HMRC research has shown that for every £1 spent on R&D, up to £2.35 of private sector investment in innovation is stimulated, so it clearly makes sense for the government to continue with the incentives.

R&D Tax Credits are designed to encourage repeat investment into R&D and drive innovation across the country. This benefits companies, the economy and society as a whole. However, despite the obvious benefits of making a claim, many of the people we speak with have either never thought about it, or have thought about it but felt their business activities do not qualify.

From the conversations we have, one thing has become clear: many people misunderstand what constitutes R&D. The criteria can be a surprisingly broad brush. Smart Currency Business actually made a successful claim not too long ago, as we discovered that the bespoke software development we had set up was classed as an innovation. We received a cash injection shortly after that we honestly did not expect to get.

Remember: if you’ve been told that you cannot claim, it’s worth double-checking with an expert.

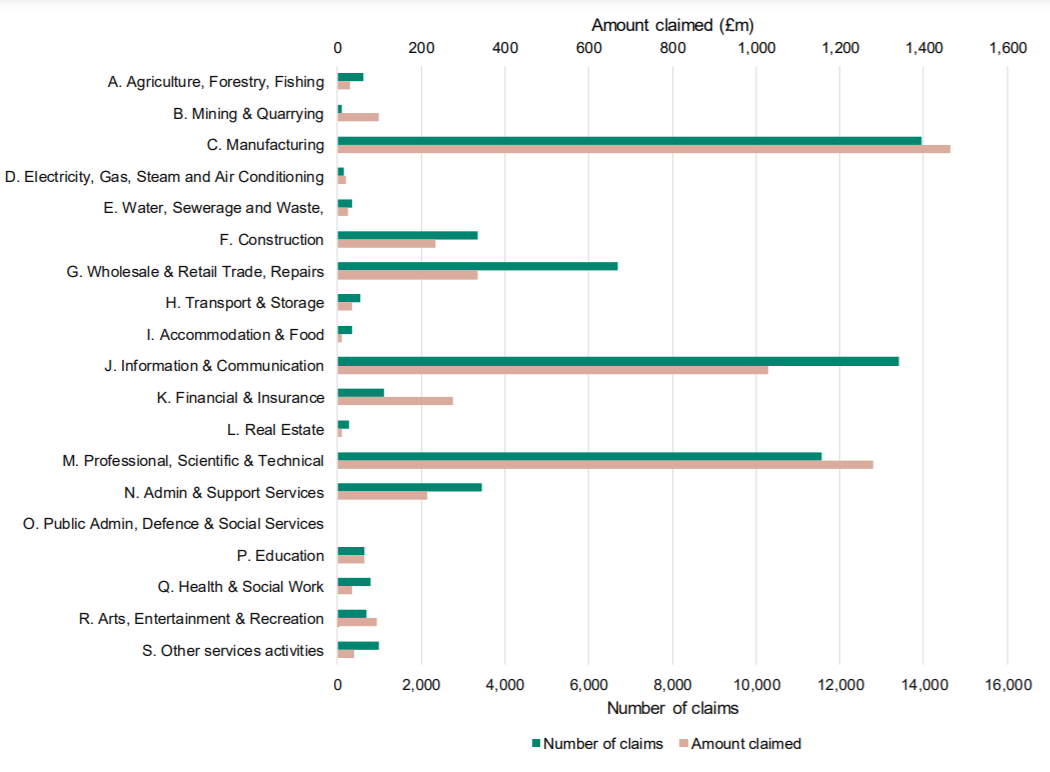

Industry Sector analysis of R&D tax credit claims, 2018-19

Dedicated R&D Tax Credit specialists

While an accountant might be an expert in various business issues, they cannot be expected to be a master of all trades. Sure, they will certainly have an idea of what constitutes R&D, but it is unlikely they will know all there is to know about what is a particularly detailed and niche area of tax.

That is why we have partnered with one of the most successful dedicated R&D Tax Credit specialists in the UK. We can reduce the time and resources you spend on a claim, help establish your eligibility, introduce you to the right partners for your business’s specific requirements and, importantly, maximise your financial benefits and reduce your risk.

A ten-minute conversation is often all it takes for a specialist to determine whether you have legitimate grounds for a claim. With that in mind, it is difficult to think of a reason not to get in touch to discuss the likelihood of your business making a successful claim.

“R&D cannot be taught, it can only be done.” – Haresh Sippy

Up to 33p for every £1 spent on R&D

In a survey conducted by one of our partners, it was found that while 94% of UK SMEs considered innovation essential and 89% intend to innovate in the next three years, only 20% have actually claimed R&D Tax Credits. Remarkable really.

When you consider that businesses can claim up to 33p for every £1 spent on qualifying activities, the average claim for a London-based SME is £81,352, and the UK average is £61,514, you do have to wonder why more companies aren’t checking whether they have legitimate grounds for a claim.

And if you are eligible, you typically have two years from the end of your accounting period to submit a claim. So if, for instance, if you file accounts to 31 December each year, you have until 31 December 2019 to make a claim for your accounting period ended 31 December 2017.

It might surprise you, but your business’s R&D doesn’t even have to be successful to qualify for tax credits. So get in touch with one of our team today for an informal discussion and we can discuss the next steps.

If you are interested in finding out more about the R&D Tax Credit scheme then give a member of our team a call today on 020 3867 3266 or email [email protected].

On Air Dining

When On Air Dining approached Smart Currency Business with a foreign currency risk management requirement, we quickly realised they might qualify for the government’s R&D Tax Credit scheme. After introducing them to one of our specialist partners they recouped £140,000 for the business.

020 7898 0500

020 7898 0500