The main aim of this report is to highlight how important currency risk management can be to businesses with foreign currency exposure.

In our years of working in the foreign exchange industry, we have learned that despite what anybody might claim, nobody knows what is going to happen to any given currency pairing from one day to the next. The sad truth is that there is no magic crystal ball to consult; we are often asked what is going to happen to the US dollar six months from now and we hold our hands up – we don’t know and neither does anyone else.

It might strike you as ironic that within this edition of our currency forecasts we are essentially telling you that forecasts aren’t worth the paper they are written on. However, while that is said with tongue firmly in cheek, it does help underline how dangerous forecasts can be if you make a decision based on them that turns out to be wrong.

In the previous edition of our currency forecasts, the maximum rate prediction for GBP/USD was £1/$1.5300, while the minimum was £1/$1.2000. Although it is true that a year is yet to elapse since those predictions were made, over the past 12 months the maximum rate for GBP/USD has been £1/$1.4346 and the minimum has been £1/$1.2366; the max rate is still almost ten cents away from what was predicted. Clearly, much of what is forecast is guesswork and often unreliable.

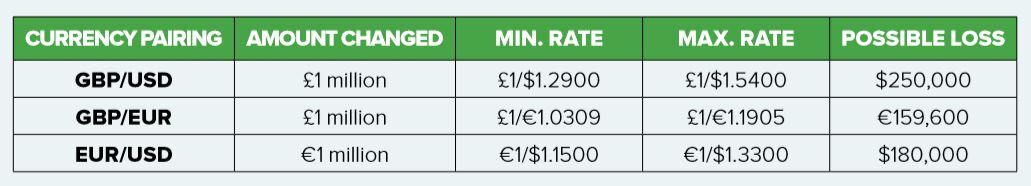

As experts in providing currency risk management consultations, we are necessarily passionate about producing informative and educational collateral that emphasises just how important currency risk management solutions can be. The chart below details the rate predictions for the next 12 months and the possible impact on your budget. If you were exchanging £1 million, the GBP/USD disparity amounts to a potential loss of $250,000!

Hence our passion for communicating this crucial point: FX should never be seen as a revenue stream, but, if the right strategic approach is taken, it is a means of achieving a definite cash flow.

Summary

The first quarter of 2018 has been a little tumultuous to say the least. Sterling and the US dollar in particular have demonstrated extreme intraday volatility, and there has been almost a 5% swing in January alone. The pound has started the year by posting its best quarter against the greenback since 2015. There was some welcome news for UK households, as the gap between inflation and wage growth has narrowed, which will ease the cost-of-living burden many people have been experiencing. Unemployment is also at its joint lowest level since 1975.

Progress has been made in the quest for a Brexit withdrawal agreement between the EU and UK. Towards the end of March, both sides jointly published a new version of the draft treaty for Brexit which suggests there is complete accord on citizen’s rights and the cost of the divorce bill. However, there is still a lot of work to do, most notably on the Irish border issue. Still, given how stultifying talks have been in the past, we should all be thankful for mercies, however small.

The Bank of England look certain to increase interest rates in May and the European Central Bank dropped its pledge to extend its quantitative easing programme if the eurozone’s economic outlook deteriorated; perhaps a normalisation of monetary policy will happen sooner than later. New Fed Chair, Jerome Powell, gave his first speech and, while US interest rates increased as expected, he did say there would only be three rate hikes in 2018. Many had been expecting four and there were some who had even tried to justify five. Still, an extra one has been forecast for 2019.

Angela Merkel’s CDU/CSU party finally reached a grand coalition deal with the Social Democrats, while the Italian election resulted in a hung parliament. There is still the chance that there will be another election later this year. Elsewhere in the eurozone, economic data has repeatedly come in below expectations, although it is worth noting that the readings still demonstrate strength.

And then there is Trump. His top economic adviser, Gary Cohn, quit following reports he was vehemently opposed to the proposed tariffs on steel and aluminium imports, and the situation has worsened since then, as the US and China appear at loggerheads. Fears of a trade war are ongoing, as the two largest economies in the world are engaged in a tit-for-tat tariff battle. After the US said it would release a list of 1,300 Chinese products that could be targeted with a 25% tariff, China responded by publishing a list of US imports on which it would levy a 25% tariff. The battle goes on and it remains to be seen who – Trump or Xi – will blink first.

This report provides an overview of the economic factors to look out for in the UK, Europe and the US over the next three months, some of the major banks’ currency forecasts for the next 12 months, and some useful resources. Enjoy!

UK – Focus on Bank of England

For the first time in a while, it looks as if the focus for the UK in the coming quarter should shift away from Brexit and instead concentrate on the Bank of England. For, while it is true there is still work to be done regarding the Brexit withdrawal agreement, the fact that a new version of the draft treaty was published in March is a significant cause for optimism.

Arguably, of more immediate important is BoE’s forthcoming interest rate decision. In March, the Monetary Policy Committee voted 7-2 in favour of keeping rates on hold. This was in line with expectations, but the market is predicting that rates will increase to 0.75% in May 2018. As it stands, it would take something remarkable for rates to remain unchanged next time around.

Here, it is worth highlighting that a rate hike has been priced into the market by more than 75%, so significant sterling strengthening is unlikely if the BoE do hike rates. However, if the Monetary Policy Committee vote against increasing interest rates, then sterling could fall against a basket of currencies.

The Central Bank’s own forecasts appear to suggest that there could be two more rate rises in the next three years, and it is possible there could be another rate hike before the year is out. If the British economy continues as expected, then rates will likely increase sooner and to a greater extent than previously thought.

We are set for a fascinating few months, beginning on 10 May 2018 when the next rate decision will be made.

Economic factors to watch in the UK

Interest rates/inflation/wage growth: UK households felt the pinch throughout last year as the gap between inflation and wage growth kept widening, but the Bank of England felt obliged to increase interest rates to 0.5% in a bid to curb inflation. Perhaps the rate hike worked, as inflation surprisingly fell to 2.7% in February and we then learned that, including bonuses, earnings rose by 2.8% in the three months to January – the biggest jump since September 2015. The Bank of England look set to increase interest rates once more in May to 0.75%, so it will be interesting to see what happens to inflation and wage growth in the second quarter of 2018 and beyond.

The UK economy: Brexit has been exerting a negative influence on the UK economy for some time now. The economy grew by just 1.4% in the fourth quarter of 2017 which is the weakest pace of expansion since the second quarter of 2012. More alarming is that annual growth of 1.8% is the weakest growth for five years and the UK has now gone from the best performing country in the G7 to the worst. However, a weak pound makes exports cheaper and boosts tourism; it is possible that these factors could stimulate the economy in the future.

UK local elections: Theresa May’s handling of Brexit and her inability to appease both soft and hard Brexiteers within her own party has led to calls for her to step down. However, her stance has always been that she is going nowhere and is committed to leading the UK. Recent suggestions of anti-semitism within the Labour party and her response to the Salisbury nerve agent attack might have boosted her popularity and it will be fascinating to see how the Conservatives fare in the first widespread electoral test since the snap election in 2017.

Europe – Focus on economic boom

In 2017, the eurozone’s economic recovery was firmly on course and all sectors showed impressive robustness. Many key releases came in above expectations and Germany – the eurozone’s largest economy – posted impressive figures throughout the year. The euro enjoyed something of a renaissance, gaining 16.3% against the dollar over the course of the year and strengthening by 4.7% against sterling.

However, all good things must come to an end and it is fair to say that the start of 2018 hasn’t been quite as good as one might have reasonably expected. The first quarter of 2018 saw the eurozone’s slowest growth for more than a year and was much weaker than had been forecast. A Reuters poll in March even went so far as to suggest that growth has peaked, which should be of some consternation to the European Central Bank which is tightening monetary policy.

Then there is the fact that eurozone factory growth hit an eight-month low in March and posted its third monthly drop in a row. German business confidence appears to be on the wane too.

Of course, all of the above comes with the caveat that growth remains strong and we could yet see the economy outperform expectations in the coming months. However, it is certainly interesting to consider whether the eurozone’s economic boom could be coming to an end and, if it does, what effect this will have on currency movements.

Economic factors to watch in Europe

Monetary policy normalisation: In March, the European Central Bank did as expected and kept its interest rates unchanged yet again. However, interestingly, the ECB dropped its pledge to extend its quantitative easing programme if the eurozone’s economic outlook deteriorated. This was a surprisingly hawkish move and appears to suggest a normalisation of monetary policy will happen at an accelerated rate. It will be interesting to see the inflation figure in the coming months, as well as any further comments about the Bank’s bond-buying programme which is due to end in September.

Trade tariffs: Trump’s decision to impose tariffs on steel and aluminium imports caused consternation the world over. Despite the 45th President of the United State’s claim that trade wars are easy to win, the European Commission formally agreed plans to retaliate by targeting sanctions on US agricultural goods, steel and other products. Trump has since threatened to impose tariffs on car imports if the EU retaliates, but there is still hope that the bloc will be excluded from the global tariff. However, one of Trump’s trade aides as said there will be no exemptions. It will be fascinating to see how the situation plays out in the coming months.

Italian coalition: As expected, the Italian election resulted in a hung parliament and it remains to be seen who will form part of the coalition in the future. However, on 4 April the leader of Italy’s anti-establishment Five Star Movement, Luigi Di Maio, ruled out forming a coalition with Silvio Berlusconi’s Forza Italia party. This is a potential spanner in the works, as Maio had previously said he was ready to talk to all parties. It now remains for rival parties to find common ground and if this cannot be achieved, we could see a new election called.

US – Focus on Trump

As is becoming standard practice for our quarterly currency forecasts, the main focus for the next three months will be on the 45th President of the United States. Trump’s continuing obsession with Twitter often has a dramatic effect on the markets and it is unlikely that he will refrain from Tweeting any time soon.

His recent Tweets about the trade agreement with China have rattled the stock markets and it remains to be be seen whether a full blown trade war between the US and China can be averted. China has said that if Trump withdraws his threatened tariffs then it will do the same, but this would require a climbdown from Trump which is something that cannot be banked on.

Then there is the continuing Robert Mueller investigation into the alleged collusion between the Trump campaign and Russia. FBI agents have recently conducted a raid on the office of his attorney, Michael Cohen, which Trump described as an ‘attack on our country in a true sense’. While it is unclear whether the raid relates to the collusion investigation, there is still the possibility that Trump could fire Mueller.

Meanwhile, former FBI Director, James Comey, is set to released a book. Entitled ‘A Higher Loyalty: Truth, Lies and Leadership’, it looks certain to reveal his side of the story and could have more of an impact than Michael Wolff’s controversial ‘Fire and Fury’.

Say what you like about Trump, but there is never a dull moment with him at the helm.

Economic factors to watch in the US

Donald Trump: It feels as if every quarter there is a fresh controversial talking point that relates to Donald Trump in some way or another. Last time the focus was on his controversial tax reforms that didn’t so much drain the swamp, as pour more money into it. This time around it is the proposed tariffs on steel and aluminium imports. Then there are the additional tariffs that Trump is threatening to slap on Chinese imports. It is impossible to predict what Trump is going to do or say from one day to the next and perhaps even he doesn’t know.

Federal Reserve: In their March meeting, the Federal Reserve did as expected by increasing interest rates by 25 basis points to 1.75%. The markets had already priced in a hike and so any resultant dollar strengthening was always unlikely. However, what was surprising was new Fed Chair Jerome Powell’s speech in which he conceded there would only be three rate hikes in 2018 and, while he did say the Fed is forecasting an extra rate rise in 2019, the fact that the markets had previously been expecting four hikes sent the dollar tumbling. It will be fascinating to see whether the Fed’s position changes throughout the course of the year.

Trade tariffs: There are ever-increasing fears that a trade war between the US and China is on the brink of being realised. As it stands, the world’s two largest economies are embroiled in tit-for-tat tariff threats and it remains to be seen whether Trump and Xi have it in them to pull back before it is too late. Any climbdown could be seen as weakness from a domestic point of view and it is entirely possible that this game of chicken could end up with both countries on course for a head-on collision. If it does, there will be plenty of collateral damage too, as the effects of a trade war will likely be felt across the world.

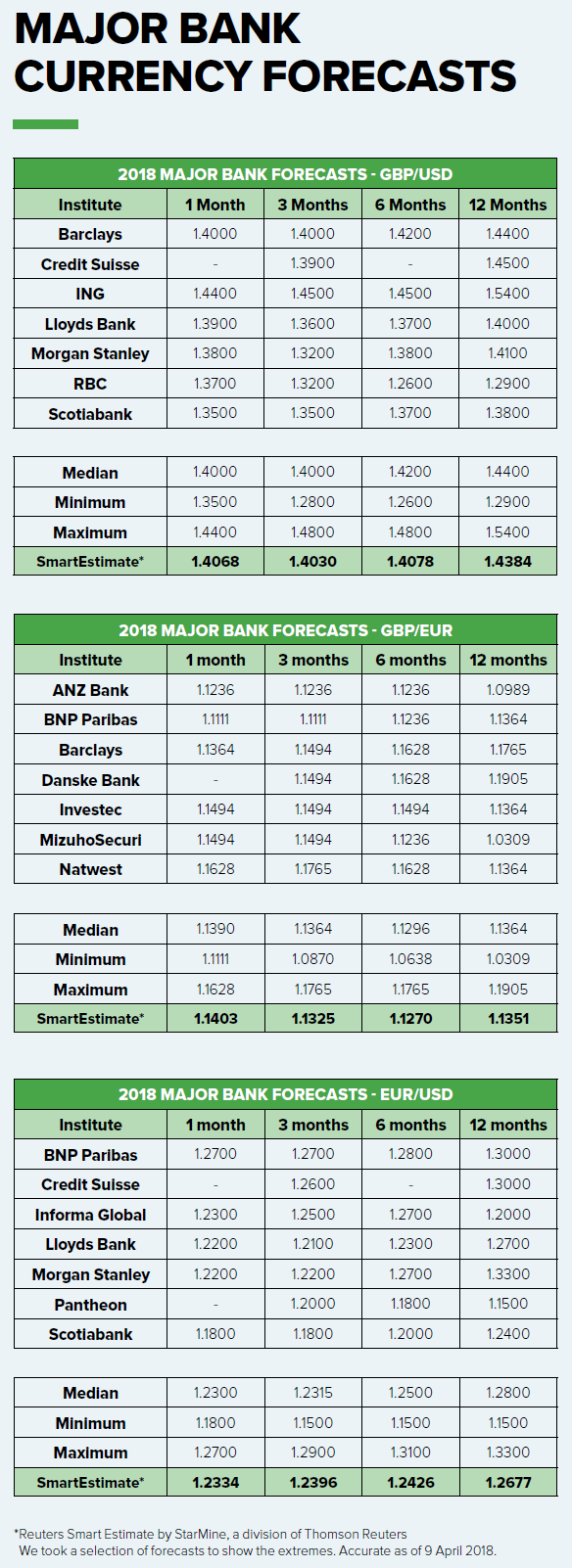

Major bank currency forecasts

Resources

Forward contract widget

Forward contracts enable you to reserve a price for buying or selling currencies on a specific date in the future. The price you lock in is determined on the day you agree the amount and settlement date for the forward contract. Forward contracts are particularly useful for businesses that have future payments or receipts in foreign currency because they allow you to protect your budget and profit margins. They can be an important part of a company’s hedging toolkit because they remove any concerns over the unpredictability of currency markets, enabling you to focus on running your business.

We have created a forward contract widget to help you identify the currency risks you could have exposed your business to by using spot contracts rather than forward contracts over the last 12 months.

Treasury Management White Paper

We have recently created a Treasury Management White Paper to help our clients understand how important currency risk management can be. We understand how difficult running a business can be, so seeing the forecasted profit margins – gross and net – being eroded by exchange rate volatility would be extremely frustrating, especially if the currency risk is manageable.

Daily Currency News

As part of our ongoing commitment to producing collateral that would be useful to our audience, we have a currency note that gets sent out every Monday, Tuesday, Wednesday, Thursday and Friday. It gives a round-up of the previous day’s market events, as well as some of the political and economic events to look out for throughout the week. It is free to register and you can unsubscribe any time you like.

Business Services

As well as being experts in international money transfers, we provide a range of different business services that can be tailored to suit your business’s specific requirements. We offer effective treasury management services, several hedging products, and methods for accelerating business growth. If you want to find out more about the services we offer, then please do not hesitate to get in touch.

About us

We are a recognised expert in international money transfers, providing UK companies with tailored currency exchange services. We help businesses mitigate risk and save money on international transfers and payments. This includes bespoke solutions that meet the specific circumstances of your business. We are also passionate about working with our clients to help them understand just how important currency risk management can be in these uncertain times, and regularly provide news, insights, guides and white papers to educate businesses.

Smart Currency Business is part of Smart Currency Exchange, which is authorised by the Financial Conduct Authority under the Payment Services Regulations 2009 (FRN 504509) for the provision of payment services. Registered in England No. 5282305.

Further information

For further information on how Smart Currency Business can help protect your profits and expand your products and services internationally, email us at: [email protected] or give us a call on 020 7898 0500.

Disclaimer: The information in this report is provided solely for informational purposes and should not be regarded as a recommendation to buy or sell. All information in this report is obtained from sources believed to be reliable and we make no representation as to its completeness or accuracy.

020 7898 0500

020 7898 0500