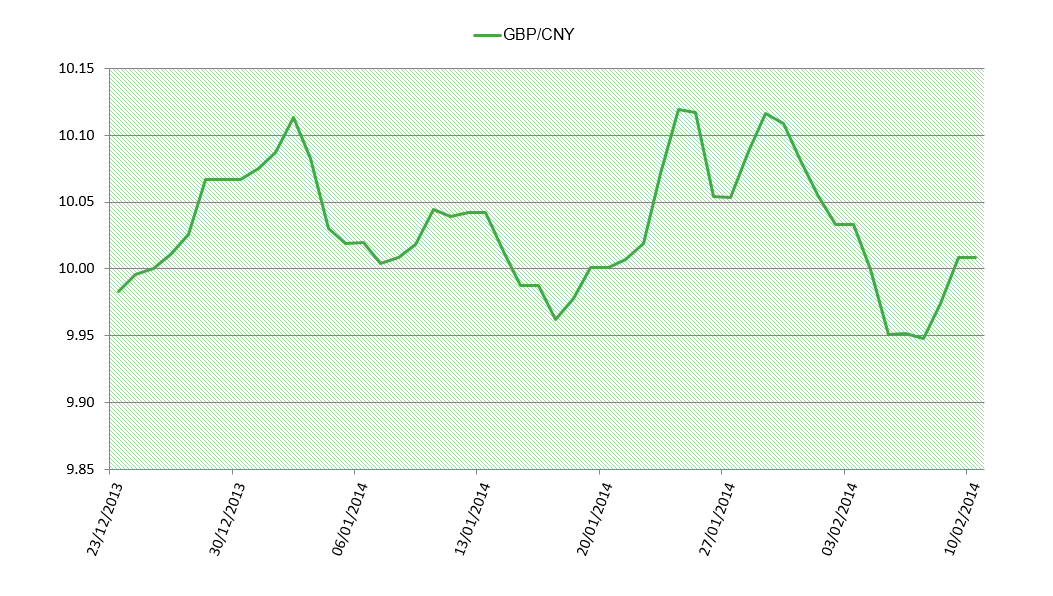

13 February 2014

CNY (Chinese renminbi) Current Rate:

CNY10.05/£1; CNY6.03/US$1

Renminbi appreciates

Renminbi has always been in a class of its own, its managed currency shielded somewhat from the ramifications of global economic events and trends. For instance, most currencies weakened against the US dollar following the US Federal Reserve’s tapering of its quantitative easing (QE) programme, but the Chinese renminbi has held steadfast, appreciating against the US dollar in the face of positive sentiment for the US economy. This is no mean feat, especially given indications in January of a Chinese economic slowdown.

The appreciation of the Chinese currency, however, is a deterrent for one of China’s main sources of revenue: exports. The theory goes that, as the currency strengthens, exports cost more, weakening Chinese export competitiveness. In reality, however, China has some way to go before losing its stronghold on its standing as a global exporter, and the People’s Bank of China (the central bank) still wields power over the exchange rate, leaving it free to depreciate the renminbi to support Chinese exports should the need persist. China is also considering other means of growth that are not export-based, which would hopefully offset potential loss in export competitivenes caused by an appreciation in renminbi.

In the meantime, the economic landscape in China was relatively muted at the beginning of February, due to the Chinese New Year. Overseas companies were advised to settle invoice payments from Chinese companies by the end of January, in order to avoid cash flow problems during the week-long national holiday.

Long-term sentiments

It seems that renminbi will continue to appreciate for the time being, due, in part, to sentiment surrounding its foreign direct investment (FDI). China ranks second in the world (after the US) in terms of FDI inflows, and as FDI investors usually cast their collective eye on the long term, China’s resolution to achieve a free-floating currency is deemed as promising, despite the slow pace at which the Chinese government is loosening its grip on the currency market reins.

Rate forecasts for GBP/CNY:

| Time Length | Rate |

| 1 month | 9.89 |

| 3 months | 9.85 |

| 6 months | 9.68 |

Rate forecasts for USD/CNY:

| Time Length | Rate |

| 1 month | 6.05 |

| 3 months | 6.04 |

| 6 months | 6.00 |

Forecasts accurate from 10 Feb 2014. Data taken from Reuters’ poll.

Data sourced from GBP/USD and USD/CNY cross.

For help and guidance on making international payments using Chinese renminbi,

call 020 7898 0500 or send us an email

020 7898 0500

020 7898 0500