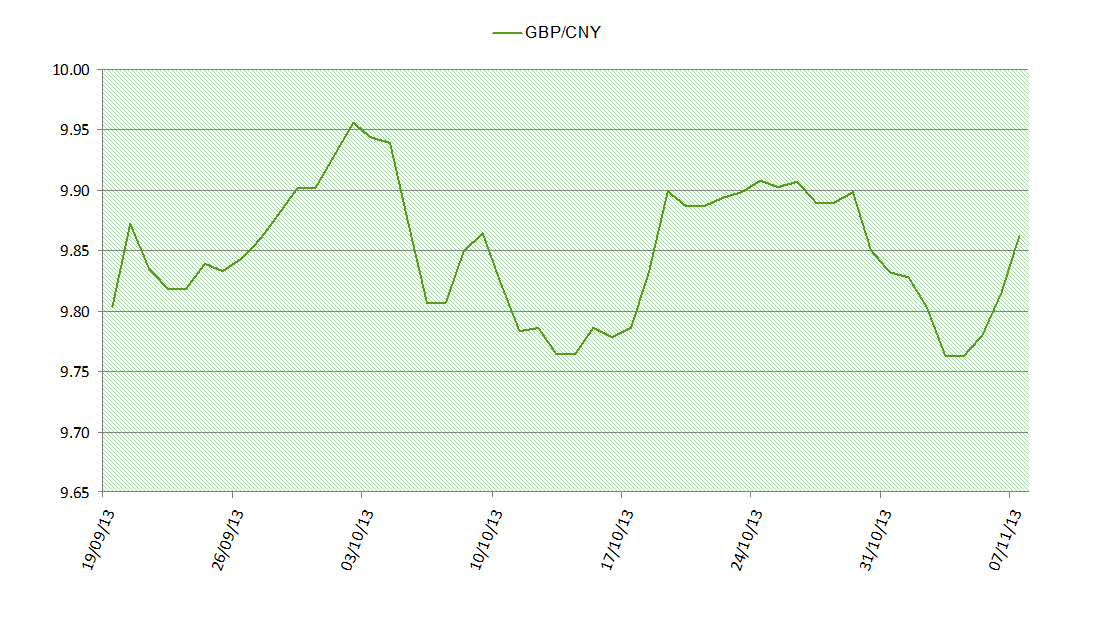

12 November 2013

CNY (Chinese renminbi) Current Rate:

CNY9.73/£1; CNY6.095/US$1

It has to be remembered that the Chinese renminbi is a currency pegged to the US dollar and that the Chinese authorities are keen that any appreciation against the US dollar is both slow in the rate of this appreciation and controlled in this manner. This is so that Chinese exports stay competitive – a key driver of their economic growth since the turn of the century.

Over the last twelve months, the renminbi has gained more than 2 per cent against the US dollar. Due to the problems in the US with their debt ceiling and their government shutdown, the renminbi has made further gains since the start of October. This has prompted the Chinese Central Bank to step in at the end of October and raise the peg against the US dollar in anticipation of further gains. Many analysts now believe the renminbi to be expensive in comparison to its true value and this could be set to continue for some time as the currency continues to appreciate against the US dollar.

Against sterling, we have seen the reverse trend. Sterling has appreciated significantly against the US dollar. This in turn has seen sterling appreciate against the renminbi.

The Chinese Government has also taken key steps to “internationalize” the renminbi by allowing financial centres such as London and Singapore to start trading it. The longer-term aim appears to be the creation of alternatives to the US dollar and the euro as world currencies. Later this month, we’ll also have figures for trade balance, manufacturing output and industrial production – all key figures for economic growth.

The general market view is that sterling will weaken against the US dollar and the US dollar will weaken against the renminbi. Therefore, we could see some significant weakness for sterling against the renminbi as detailed in the combined consensus bank forecasts below.

Rate forecasts for GBP/RMB:

| Time Length | Rate |

| 1 month | 9.76 |

| 3 months | 9.68 |

| 6 months | 9.54 |

Forecast accurate from 8 November 2013. Data taken from Reuters’ poll.

Data sourced from GBP/USD and USD/CNY cross.

For help and guidance on making international payments using Chinese Renminbi, call 020 7898 0500 or send us an email

020 7898 0500

020 7898 0500