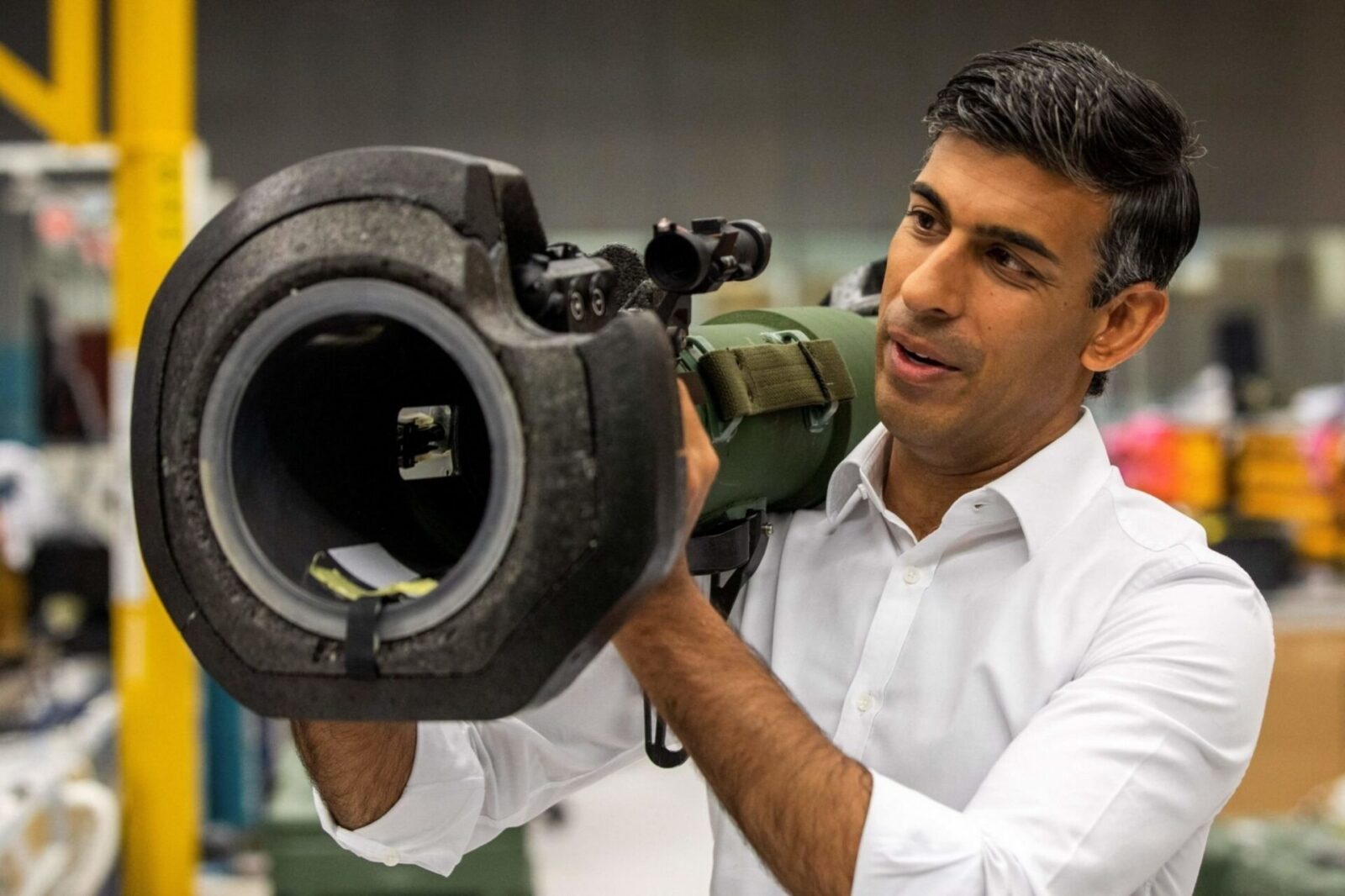

Rishi Sunak marks 100 days as PM with economic growth in his sights (Salma Bashir Motiwala / Shutterstock.com)

Global stocks rose yesterday as the markets reacted to hopes that inflation is beginning to slow and that central banks are about to take their foot off the pedal on interest rate rises, if not going into reverse just yet. The Nasdaq in the US climbed by 3.5% and the FTSE by 0.7%.

Neither rising equities nor the Bank of England’s (BoE) interest rate hike of 50 basis points to 4% was of help to sterling against the euro, however, which dropped nearly 1% in advance of the announcement, then rallied, then gently declined again. GBP/EUR now sits close to its lowest point for two years.

It comes amid a report from the IMF that the UK economy would be the only industrialised economy in recession this year, and a report from the Bank of England that broadly agreed, but if anything was more pessimistic.

Against the US dollar, sterling has weakened around 1.5% over the course of the three major interest rate announcements from the Fed, European Central Bank (ECB) and BoE. The ECB also raised its headline rate by 50bp and signalled that it would do so again next month, while the Fed raised by 25bp.

So far the euro has been the winner overall, ending the week stronger against all major rivals except for the Japanese yen (JPY) and Swiss franc (CHF), over 1.5% stronger against sterling than last Friday.

There could be more to come, however. This morning we are hearing final readings for PMI in the UK and major eurozone economies

Later today US jobs data will arrive in the form of non-farm payrolls and the unemployment rate – always a good gauge of the US (and therefore the global) economy’s health.

Apple has already reported its first decline in revenues in three and a half years, blaming supply problems from China. However, it has not, unlike other tech giants, instigated large-scale lay offs.

Make sure any upcoming transactions are protected against the risks of sudden market movements. Secure a fixed exchange rate now with a forward contract; call your Business Trader on 020 3918 7255 to get started.

GBP: Sterling loses as bad news strikes again

It’s been a torrid week for sterling, losing across the board by between 1 and 2.5% against major rivals.

The news has been almost universally bad. The Bank of England’s deputy governor commented that Brexit was damaging the UK economy as expected but more quickly than expected too. Strikes have continued throughout the week, with post, rail and civil service functions most affected. There was also a generally poor report from the IMF and questions even from his own party as to the effectiveness of Rishi Sunak’s premiership after 100 days.

However, Shell has announced its largest profits in 115 years – £32bn in 2022.

Bank of England chief economist Huw Pill told Times Radio this morning that while the Bank is determined to “see the job through” to bring inflation back to acceptable levels, they are wary of raising borrowing costs too high.

There is a final reading for PMI at 9.30am. The early part of next week includes data on house prices and new car sales.

GBP/USD past year

EUR: Single currency boosted by ECB and wave of optimism

The euro ends the week almost 2% up on sterling and ending just a little ahead of the US dollar in a week where the ECB raised its headline interest rate to 3% and indicated that it would rise again to 3.5% next month.

Germany’s trade surplus was revealed to have risen to €9.7bn in December – ahead of expectations – but with trade with China down significantly.

There is positivity in Europe. In the Spanish economy both services and composite PMI were way ahead of expectations while French industrial production grew by 1.1% in December. More industrial data will be trickling through this morning and into early next week, but overall next week is quiet.

USD: Dollar performance patchy

A mixed week reaches its final day with the dollar flying high against the pound and most commodity backed currencies (NOK, AUD etc) but falling behind other ‘safe haven’ currencies like JPY and CHF.

The Fed was the odd bank out this week, raising headline rates by just 25bp, albeit to a higher level overall (4.75%) than in the UK or Europe.

Some effects of that rise in interest rates will be heard today, with non-farm payrolls and also the ISM non-manufacturing PMI early this afternoon. Will last month’s unexpected and dramatic fall to below 50 be repeated or reversed?

Next week is a relatively quiet one for data in the USA.

For more on currencies and currency risk management strategies, please get in touch with your Smart Currency Business trader on 020 3918 7255 or your Private Client trader on 020 7898 0541.

020 7898 0500

020 7898 0500