UK manufacturing figures disappoint – will services and construction do the same?

By Ricky Bean July 4th, 2017

We’re slowly getting used to disappointing UK economic data but amidst the latest UK rate hike speculation, sterling markets clearly haven’t priced in any disappointments.

Should the data for the UK’s dominant service sector follow the trend tomorrow, we could see sterling under pressure. Equally, if the service sector has performed well we’ll probably see the pound strengthen and calls for rate hikes become louder.

On another note, our private client business, Smart Currency Exchange, will be taking part in a webinar for people looking to buy a holiday or retirement home in Spain. If that is something you’re considering, please register now to attend the webinar.

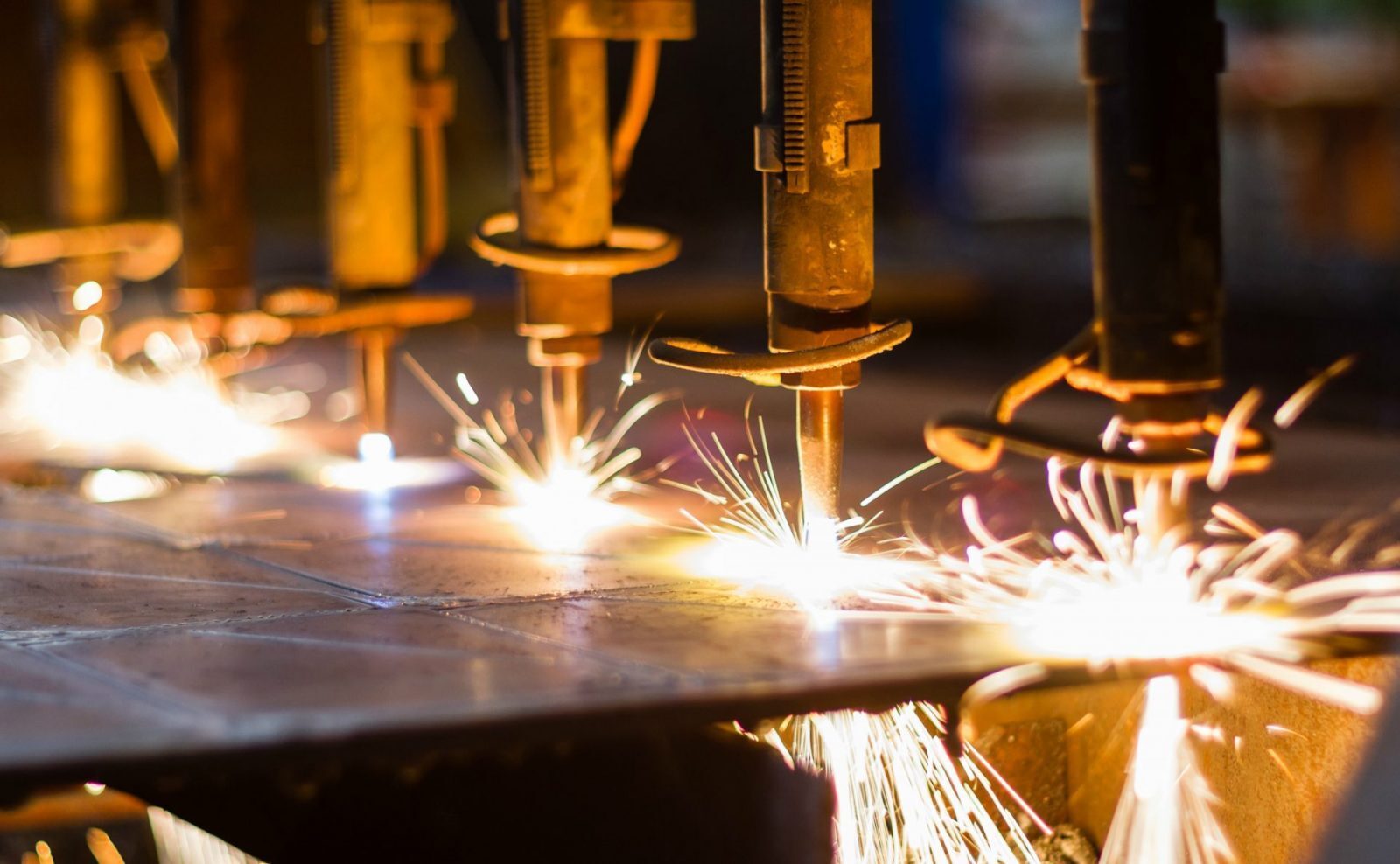

GBP: more poor UK economic data released

Sterling came under a little bit of pressure yesterday as the UK’s manufacturing purchasing managers’ index disappointed. A below-market-estimate reading of 54.3 dragged on sterling whilst last month’s figure was also revised downwards, compounding losses.

The recent string of poor data has started to raise doubts that the UK’s relatively strong performance in the months following the Brexit vote IS sustainable.

Today we’ll see construction PMI figures released and tomorrow it’s the turn of the services PMI data. Both will be key to sterling’s performance and traders will be keen to see if there is any improvement from yesterday’s figures.

US banks will be shut today in observance of Independence Day. This can lead to irregular volatility in the markets.

EUR: euro losses ground against the US dollar

The euro stayed relatively flat against sterling but lost ground to a stronger US dollar yesterday.

Eurozone manufacturing PMI data was revised up slightly to 57.4 but had little impact on the market.

We also saw some poor labour data out of Italy, which showed the unemployment rate is worse than expected and had risen to 11.3%, whilst the overall unemployment rate in Europe stayed steady at 9.3%.

Today we have Spanish unemployment change figures and inflation data from Europe as a whole.

US banks will be shut today in observance of Independence Day which can lead to irregular volatility in the market.

USD: manufacturing data boosts dollar

A positive start to quarter three for the US dollar, much needed after its worst quarterly performance in seven years!

This strength has come from private index results indicating higher-than-forecast manufacturing activity for the month of June, at its highest level for three years.

Today is Independence Day across the US, so dollar movement is expected to be fairly muted.

Tomorrow, however, brings the Federal Reserve’s meeting minutes and Friday we’ll be hearing US employment figures (non-farm payrolls). Two key data pieces which could quite easily create volatility in the dollar markets.

For more on currencies and currency risk management strategies, please get in touch with your Smart Currency Business trader on 020 7898 0500 or your Private Client trader on 020 7898 0541.

020 7898 0500

020 7898 0500